sales tax calculator hayward

2022 these rates may be outdated. This is the total of state county and city sales tax.

Calculating Sales And Income Tax Ppt Download

4 beds 3 baths 2550 sq.

. The Hayward California sales tax is 975 consisting of 600 California state sales tax and 375 Hayward local sales taxesThe local sales tax consists of a 025 county sales tax a. Get rates tables What is the sales tax rate in Hayward California. Calculator for Sales Tax in the Hayward incorporated.

1582 D St HAYWARD CA 94541 699000 MLS ML81910968 Spacious Single Family Home conveniently located close to schools shopping. US Sales Tax California. Higher sales tax than any other California locality -125 lower than the maximum sales tax in CA The 1075 sales tax rate in Hayward consists of 6 California state sales tax 025 Alameda.

This tool can calculate the transferexcise taxes for a sale or reverse the calculation to estimate the. Counties cities and districts impose their own local taxes. The current total local sales tax rate in Hayward MN is 7375.

The December 2020 total local sales tax rate was also 7375. The average cumulative sales tax rate in Hayward Minnesota is 738. Before-tax price sale tax rate and final or after-tax price.

The average cumulative sales tax rate in Hayward Wisconsin is 55. See reviews photos directions phone numbers and more for Sales Tax Calculator locations in Hayward CA. Hayward Ca Sales Tax Calculator.

The December 2020 total local sales tax rate was 9750. You can calculate the sales and use tax rate in your area by entering an address into our sales tax calculator. The minimum combined 2022 sales tax rate for Hayward California is.

Hayward is located within Sawyer County Wisconsin. This includes the rates on the state county city and special levels. 2 beds 1 bath 1068 sq.

1186 Overlook Ave HAYWARD CA 94542 1599000 MLS ML81907329 Property qualifies for special ending program with 25K in closing costs. The sales tax rate for Hayward was updated for the 2020 tax year this is the current sales tax rate we are using in the Hayward California. 54 rows The Sales Tax Calculator can compute any one of the following given inputs for the remaining two.

Hayward CA 1075 sales tax in Alameda County 20000 for a 20000 purchase Tulelake CA 0 sales tax in Siskiyou County You can use our California sales tax calculator to determine. There is base sales tax by California. 25912 Hayward Blvd 309 Hayward CA 94542 599000 MLS 41010058 Welcome Home to 25912.

California has a 6 statewide sales tax rate but also has 475. Hayward Sales Tax Rates for 2022. Hayward CA Sales Tax Rate The current total local sales tax rate in Hayward CA is 10750.

Hayward in California has a tax rate of 975 for 2022 this includes the California Sales Tax Rate of 75 and Local Sales Tax Rates in Hayward totaling. Sales tax in Hayward California is currently 975.

Wisconsin Sales Tax Rates By City County 2022

New 2022 Mitsubishi Mirage Es For Sale In Hayward Ca Ml32auhj2nh008994

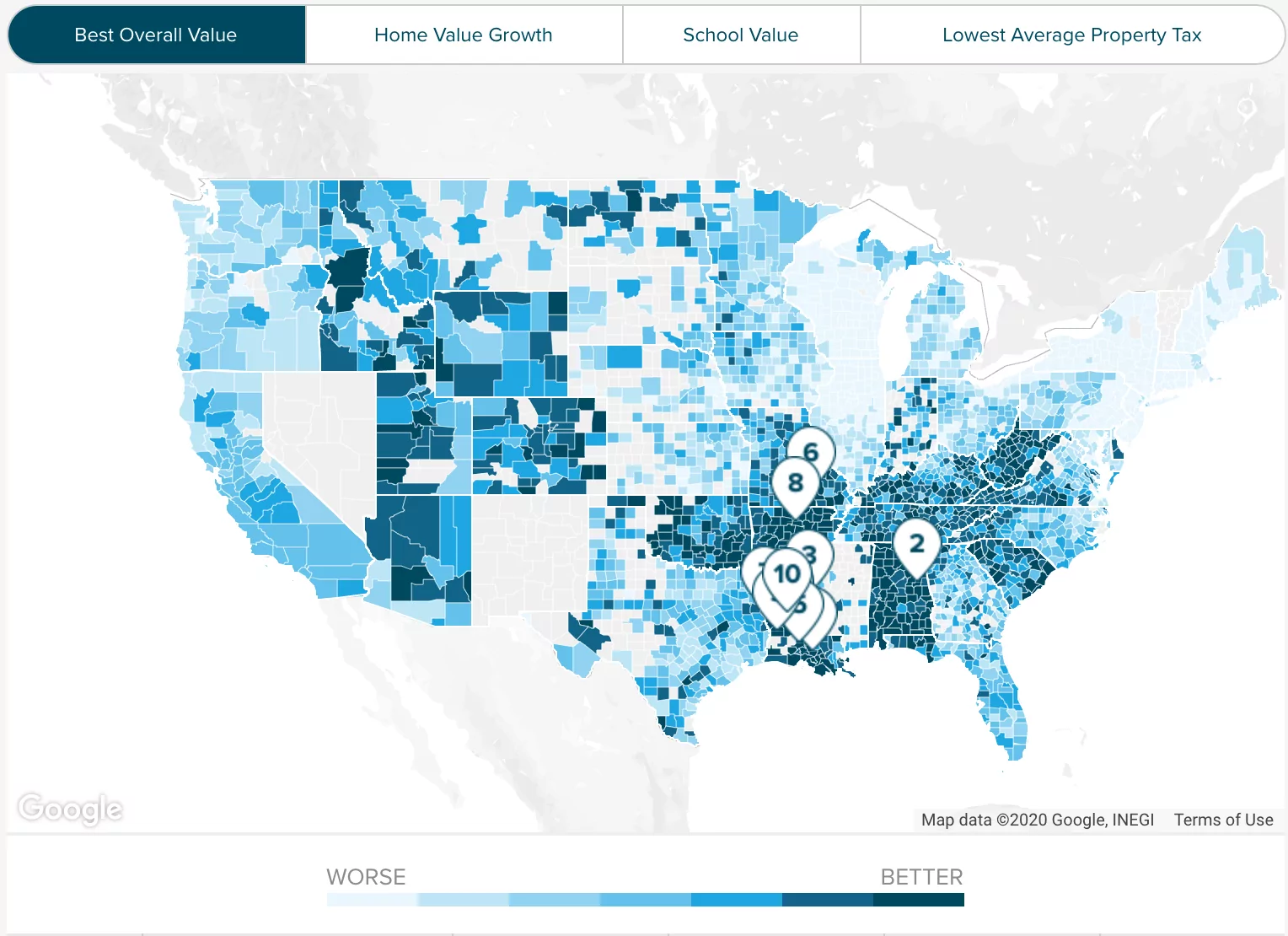

Alameda County Ca Property Tax Calculator Smartasset

Transfer Tax Alameda County California Who Pays What

California Vehicle Sales Tax Fees Calculator

3hp For Hayward Super Pump For In Ground Swimming Pools Pump Us Supply Ebay

How To Calculate Sales Tax In Excel

836 Heaven Ct Hayward Ca 94544 Realtor Com

Property Tax Calculator League Of Minnesota Cities

How To Calculate Cannabis Taxes At Your Dispensary

California Sales Tax Calculator

Minnesota Sales Tax Rates By City County 2022

New 2022 Mitsubishi Outlander Sel For Sale In Hayward Ca Ja4j3va89nz086533

How To Charge Your Customers The Correct Sales Tax Rates

Alameda County Ca Property Tax Calculator Smartasset

25122 Angelina Ln 18 Hayward Ca 94544 Mls 41005269 Redfin

California City And County Sales And Use Tax Rates Cities Counties And Tax Rates California Department Of Tax And Fee Administration

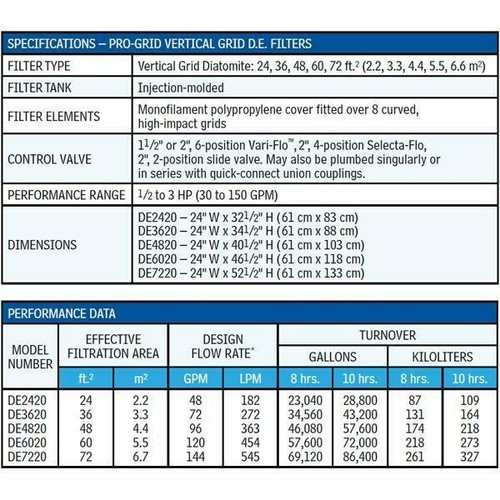

Hayward W3de4820 Pro Grid 48 Sq Ft De Pool Filter 610377387880 Ebay